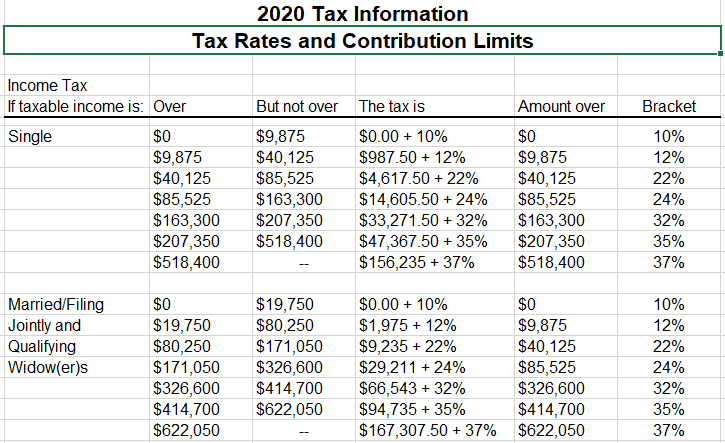

These will be in place through the 2025 fiscal year, after which time, with no Congressional action, the tax rate will increase for all except the lowest. The seven brackets remain the same next year 10%, 12%, 22%, 24%, 32%, 35% and 37% which were set after the 2017 Tax Cuts and Jobs Act. What are income tax brackets and how do they work?.VA disability and military retirement COLA 2023 adjustment.Social Security COLA 2023: How much will benefits increase next year?.Medicare Premiums Part B: How much will it cost in 2023.Here’s a look at what has changed for 2023. As well the standard deduction that taxpayers can claim when filing. However, on the bright side, the high inflation over the past year meant that the income thresholds for the seven federal tax brackets got a generous increase.

#CALIFORNIA INCOME TAX BRACKETS UPDATE#

To help in this endeavor the IRS publishes an update to tax brackets and codes each year.Īmericans don’t need to be reminded that prices have been rising, they just need to go to their local supermarket. By taking into consideration changes that you will be making, like buying or selling a house, getting married or investing in a retirement account to name a few, can help avoid having a surprise bill from Uncle Sam even get a much bigger tax refund. American taxpayers should to stay up to date on the latest filing requirements and tax burden they could be exposed to.

Getting your tax plan in order for 2023 can save you time and a fair share of money. “By failing to prepare, you are preparing to fail” Benjamin Franklin is credited with saying.

0 kommentar(er)

0 kommentar(er)